Personal | July ~ August 2025

Shipping a full-stack trading advisor

OVERVIEW

Automating a data-driven trading operations strategy

My family took a class on Turtle Trading, and I wanted to automate the process of trading and minimize the impact of human emotions. From finding the right stocks with strong momentum to risk management, I wanted to build a Jarvis-like assistant that would help me make data-driven decisions.

PLANNING

Everything to be a formula of repeated tasks

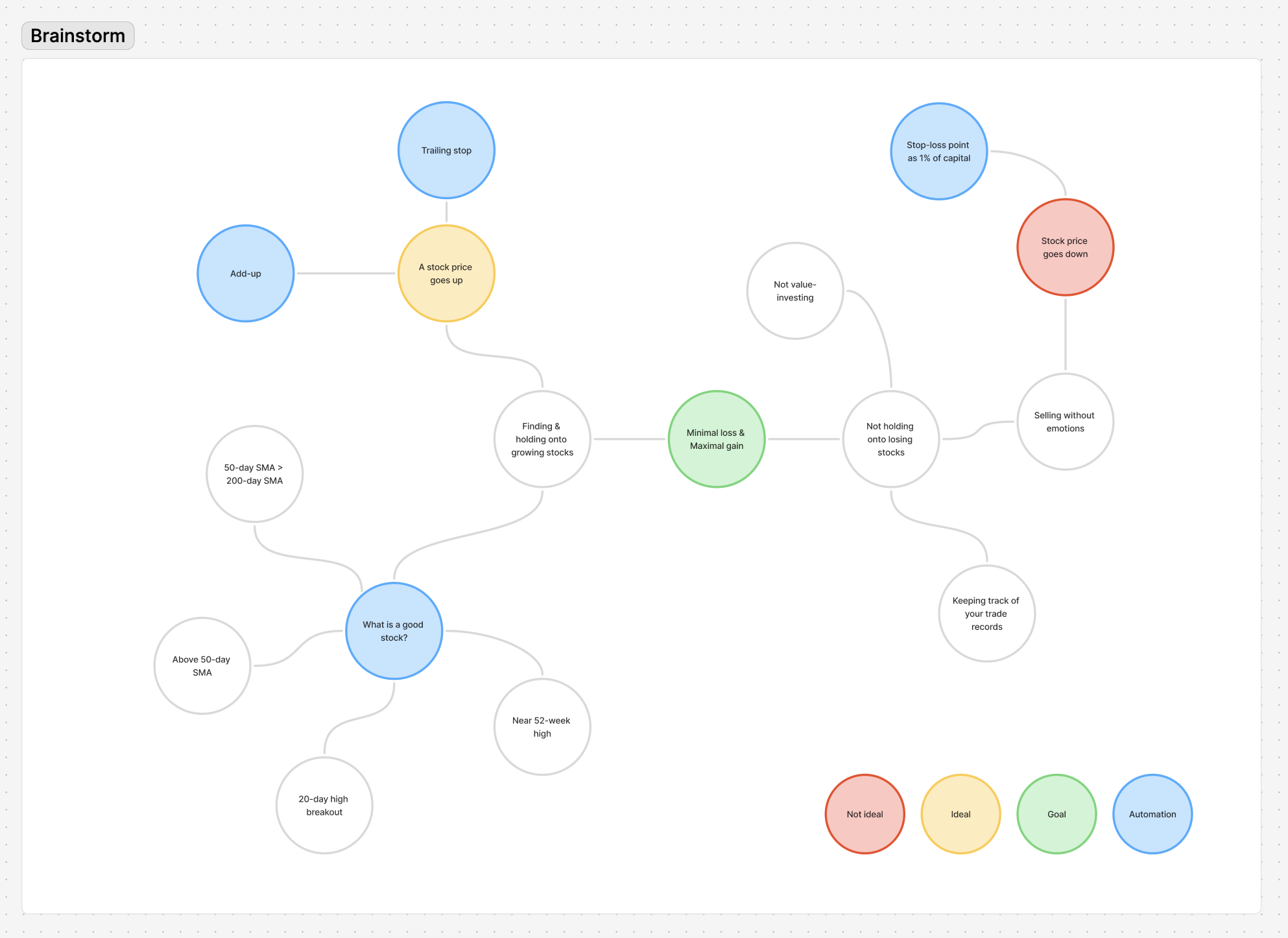

When trading stocks, there are mainly two components of actions – buying and selling. The goal is to minimize the loss and maximize the profit.

Core components of a systematic trading advisory platform

Pre-entry

- Market scanner: Monitors multiple markets for trading opportunities. Finds and suggests stocks that satisfy the designed criteria.

Entry

- Entry point: Checking the stock's momentum, volatility, and market strength indicators.

- Position size: Calculated based on user capital, risk tolerance, and stock's volatility.

Post-entry

- Stop-loss calculation: Depending on the risk tolerance, the stop-loss is calculated as a percentage below of the entry price.

- Risk Management: Automated position sizing based on account size and volatility, plus dynamic stop-loss adjustment.

- Add-up: When a stock price goes up to a certain point, we buy more shares, joining the trend.

- Trailing stop: When adding up, we need to calculate the trailing stop to protect the profit while not exiting too early.

IMPLEMENTATION

Technical architecture

The platform is built with a modular architecture that prioritizes reliability, performance, and maintainability:

Backend Infrastructure

- FastAPI with Uvicorn ASGI server

- JWT Authentication, password hashing

- Configurable CORS protection

Frontend Application

- React.js for hooks and functional components

- Tailwind CSS for styling

- Firebase hosting configuration

- Node.js for npm and package management

Database

- SQLite for development, PostgreSQL for production

- SQLAlchemy ORM with Alembic migrations

Data Pipeline

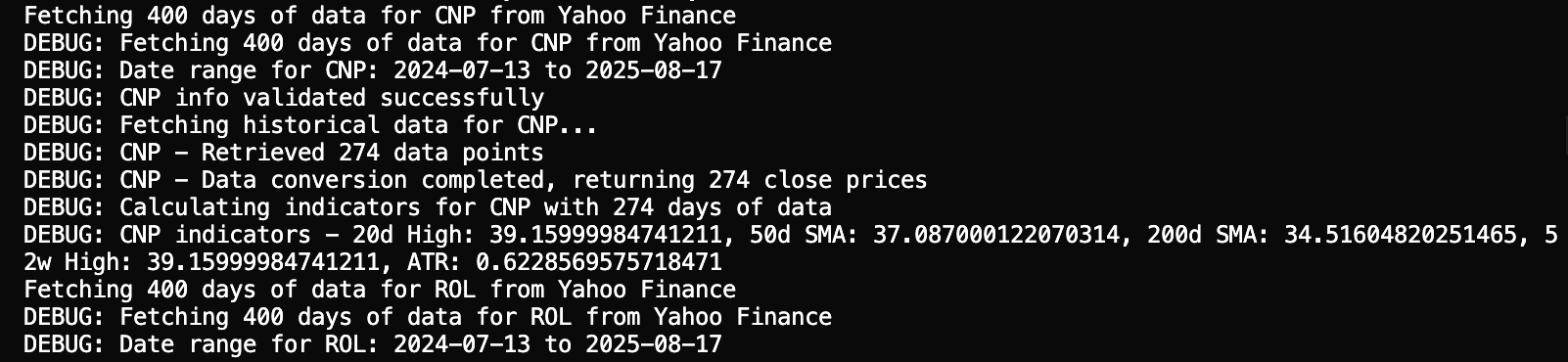

- Yahoo Finance API for historical data

- FinnHub API for real-time quotes

- API response-driven frontend state synchronization

MODIFICATIONS

From manual bottlenecks to automated flow

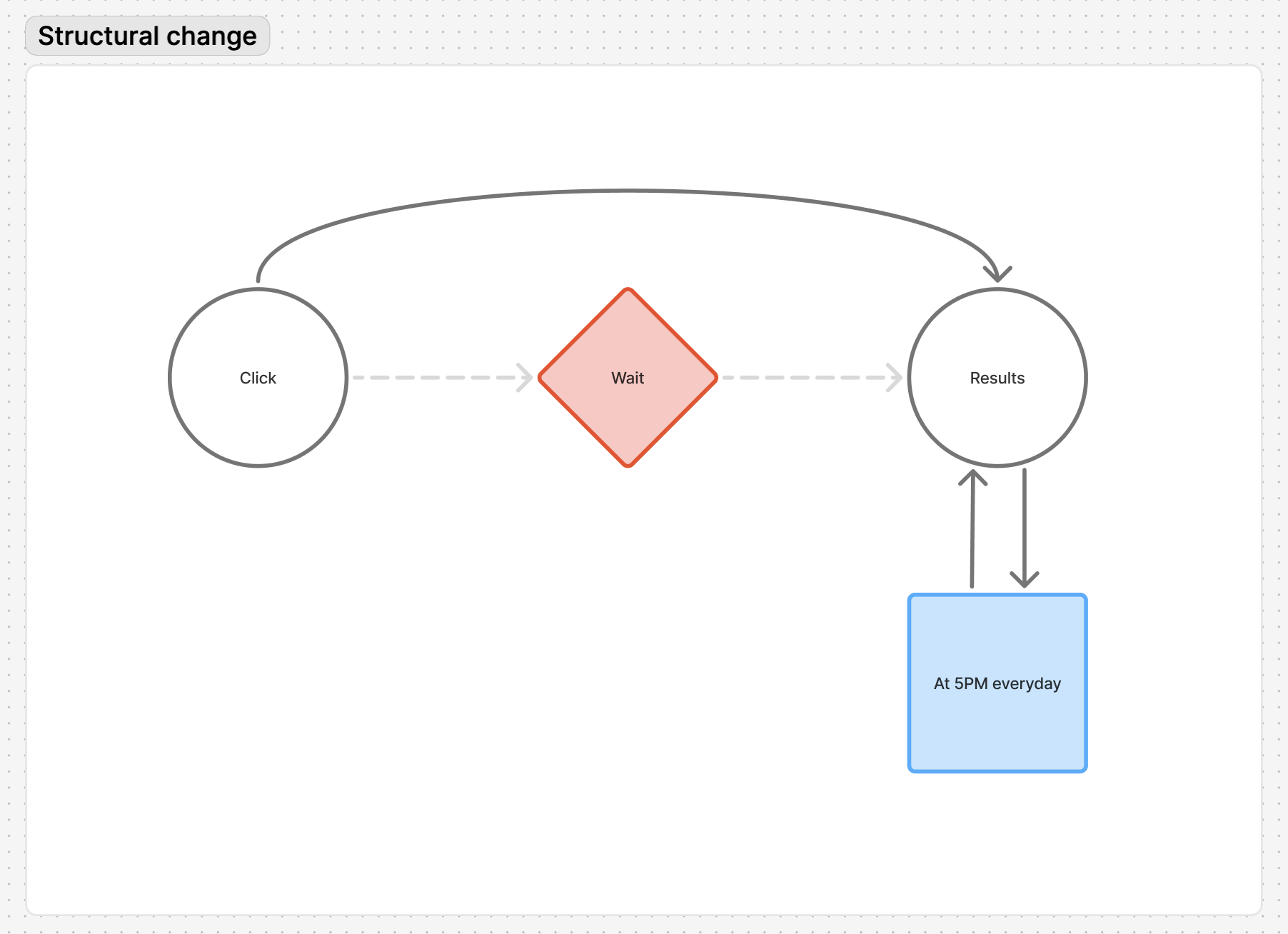

Beginning the flow on demand, it took more than 5 minutes to get the daily analysis done for ~600 stocks. This was a problem because the execution regularly exceeded the system's time limit. This would lead to timeout errors.

Previously...

- Users had to trigger manually each time

- Processing 600+ stocks took time

- No automation or progress visibility

- Click -> wait -> results, with unpredictable timing

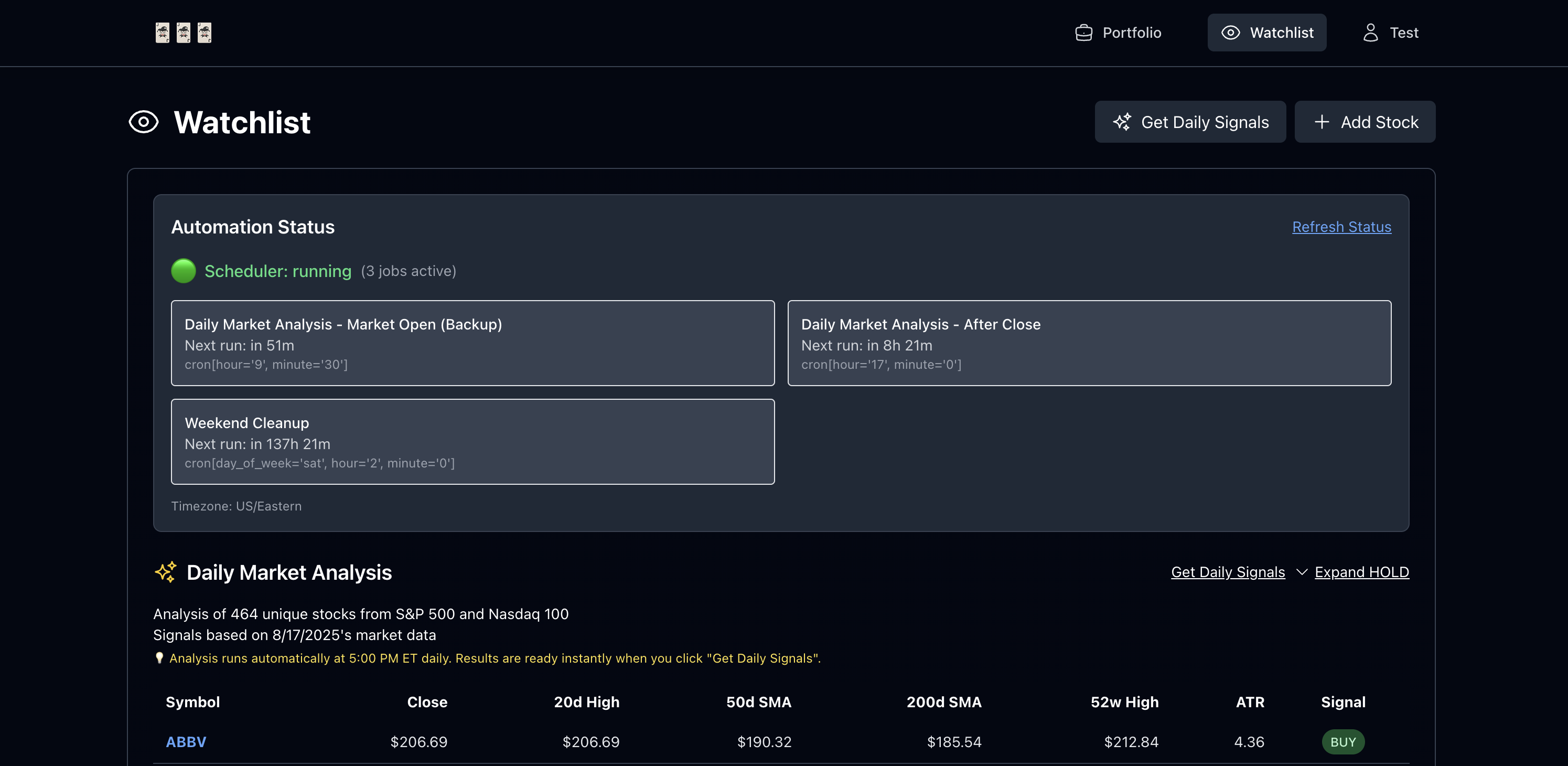

But now...

- Analysis now runs automatically at 5:00 PM ET

- Results are cached in DB and instantly available

- Fallback established for unexpected errors

- Users see system status, next run times, and health

- Click -> results, consistent and transparent

Key benefits

- Performance: 0.1s response vs several minutes on demand

- Transparency: clear status and scheduling info

- Efficiency: no redundant runs

- Robustness: backup scheduling and error handling

RESULTS

Log In

Daily Market Analysis

Adding Stock

Add Up

Selling

Trade History

TAKEAWAYS

Efficient code

With copilot tools like Cursor, it's insane how fast I can build. However, that makes it more important to have the technical understanding to make informed decisions.

Information architecture

For a full-stack perspective, it's crucial to establish a sustainable architecture that can scale – especially regarding data flow and how to optimize it.

Version control

Many times, updated codes ended up with a compile error. It was important to keep track of every changes, and go through the trial and error process to fix it.